Break-Even Point – Why All Business Owners Should Know This Number Right Now!

Break-even point is such an under-rated and under monitored number. But with the costs of doing business climbing at an incredible rate at the moment, it’s a number all business owners should know…and monitor!

If you don’t know what your Break-Even Point is right now, I urge you to review your numbers and work it out, it’s a powerful number to know!

What is Break-Even Point?

Break-even point is where total revenue equals total expenses, you are not making a profit nor a loss. It’s an important number as it tells you the point where your total revenue covers your total expenses.

Why should you know your Break-Even Point?

Knowing your break-even point can help you with:

- Determining your selling price

- Anticipating profit (or loss)

- Budgeting & Business Planning

Identifying your break-even point can also help you work out:

- how far sales can decline before you start to make a loss

- the number of units you need to sell before you make a profit

- if reducing price or volume of sales will impact your profit

- how much of an increase in price or volume of sales you will need to make up for an increase in fixed costs

The lower the break-even point the better. When business costs increase (variable or fixed), it will increase your break-even point, and this means your profits will decline if you don’t adjust your selling prices (or reduce expenses).

By knowing and monitoring your break-even point, you will be able to ensure you are pricing your products or services in a manner that allows for profit.

The difference between Fixed and Variable Expenses

Expenses for a business can be spilt into two types;

- Variable Costs (Cost of Sales)

- Fixed Costs (Operating Expenses)

Variable costs are the direct costs tied to the production of a business’ goods and services (materials, contractors, stock etc).

Fixed costs or operating expenses are expenditures that are not directly tied to the production of goods or services, these expenses are incurred even if NO sales are being made (rent, telephone, electricity etc).

Whilst both are business expenses, they are kept separate when being recorded for the business for the purpose of P&L reporting and being able to work out Gross & Net Profit Margins accurately.

Why is this important?

To understand break even points and know if you are pricing your products to make a profit, you need to be able to work out your Gross Profit Margin.

Your gross profit margin is the percentage of sales dollars left after subtracting the cost of goods sold from the total sales figure.

So how do you work out your Gross Profit Margin? First you need to calculate Gross Profit:

A business has total sales of $150,000 and Variable Costs (COS) of $50,000

- Total Sales of $150,000 – COS of $50,000 = $100,000 – this is the Gross Profit

From there you can calculate the Gross Profit Margin as a percentage by using this formula

- Gross Profit $100,000 / Total Sales $150,000 x 100 = 66.66% – this is the Gross Profit Margin

You can then use these formula’s to determine the gross profit margin on each of the products/services that you sell.

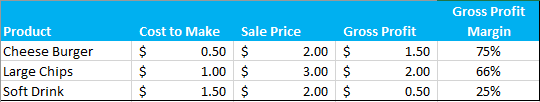

Take a look at the example below.

From this we can see that the most profitable product sold is the Cheeseburger.

The product with the smallest profit margin is the Soft Drink.

How can you work out your Break-even Point?

There are a few ways, but one simple formula uses your fixed costs and gross profit margin to determine your break-even point (sales).

Break-even point = fixed costs / gross profit margin

If your total fixed costs were $60,000, and your gross profit margin was 58%, your break-even point would be = $103,448

Formula: $60,000 / .58 = $103,448

This tells us that $103,448 in sales would mean you would not make a profit…nor a loss, you would Break-Even.

Any sales made over and above this figure would be profit.

Reach out to us if you would like any assistance with your business!